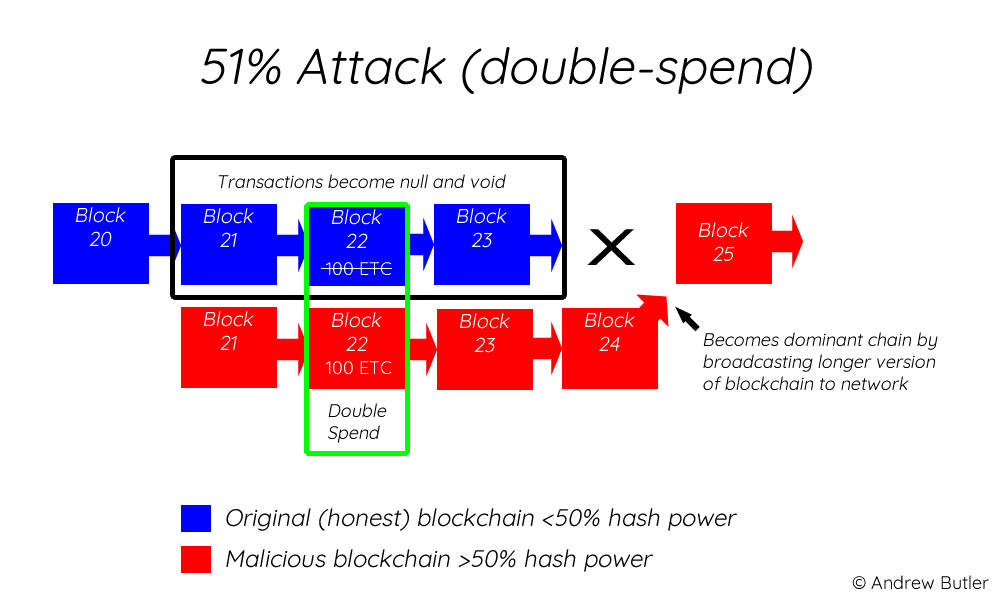

A 51% attack refers to an attack on a blockchain like Bitcoin by a group of miners controlling more than 50% of the network's mining hash rate, or computing power. The attackers would be able to prevent new transactions from getting confirmed, allowing them to stop payments between some or all users.

They would also be able to reverse transactions that were made while they were in control of the network, meaning they could double the coin spend. They can send a transaction and reverse it, making it look like they still had the coin they just spent. This vulnerability, known as double-spending, is the digital equivalent of a perfect forgery and the basic cryptographic hurdle that blockchain has overcome, so a network that allowed double-spending would quickly suffer a loss of trust.

They would almost certainly not be able to create new coins or modify old blocks, so a 51% attack would probably not completely destroy the blockchain, even if it proved to be very damaging. Nevertheless, there have been several blockchains that have suffered a 51% attack including Verge, Bitcoin Gold and Ethereum Classic. Note that nowadays, a 51% attack on the Bitcoin blockchain is estimated to cost the attacker about $2 billion. If the hash rate of the blockchain is important, then it will be more secure. To protect against attacks, exchanges require several confirmations of the transaction.