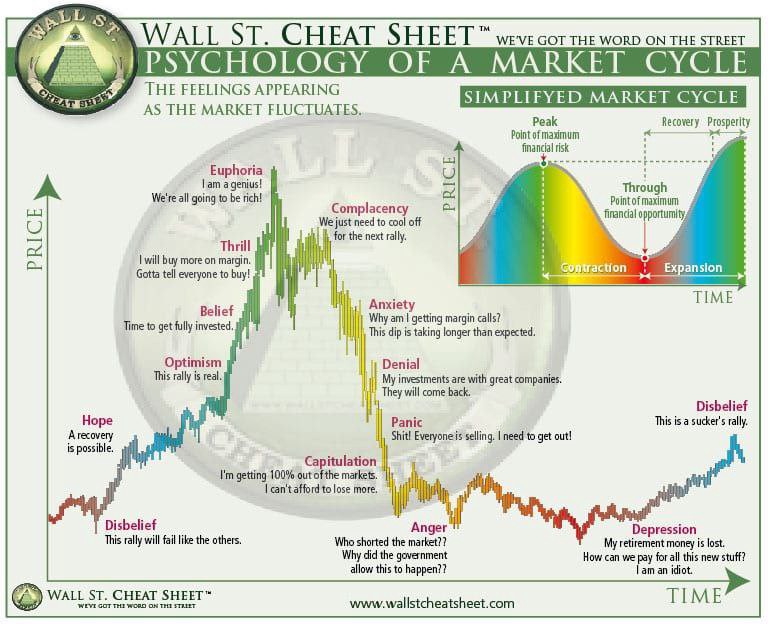

Capitulation is when investors give up any previous gains in a security or market by selling their positions during periods of decline. Capitulation can occur at any time, but it usually occurs during high-volume trades and prolonged declines in securities. A stock market correction or Bear Market often causes investors to capitulate or panic.

The term is derived from a military term that refers to surrender. The belief is that anyone who wants to sell stocks for any reason, including forced selling due to margin calls, has already sold.

The price should then, theoretically, reverse or bounce off the lows. In other words, some investors believe that capitulation is a sign of a bottom before an uptrend. Many market professionals consider it a sign of a price decline and therefore a good time to buy again.

The problem with capitulation is that it is very difficult to predict and identify. There is no magic price for capitulation. Often, investors will only agree after the fact on when the market has actually capitulated.