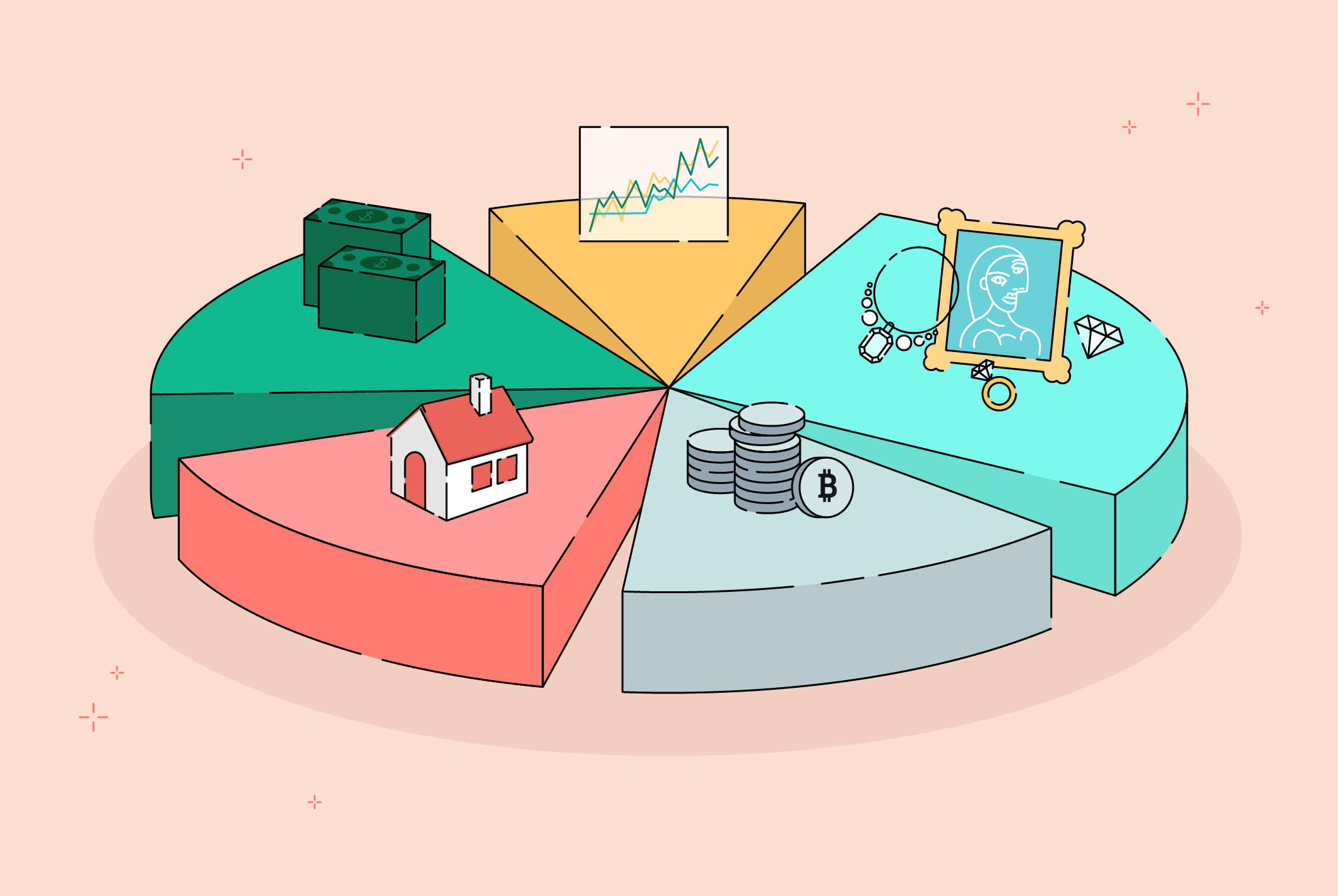

Diversification is a risk management strategy that combines a wide variety of investments within a portfolio. The rationale behind this technique is that a portfolio made up of different types of assets will, on average, produce higher long-term returns and reduce the risk of a particular portfolio or security.

This strategy is designed to mitigate the unsystematic risks of a portfolio, so that the positive returns of some investments offset the negative returns of others. The benefits of diversification are only valid if the securities in the portfolio are not perfectly correlated, i.e. if they react differently, often in opposite ways, to market influences.

Studies and mathematical models have shown that maintaining a well-diversified portfolio of 25 to 30 securities is the most cost-effective level of risk reduction. Investing in a larger number of securities provides additional diversification benefits, but at a significantly lower rate.

There are many benefits to diversification, but there are also drawbacks. The more securities a portfolio holds, the more time-consuming it can be to manage and the more expensive it is, as buying and selling many different securities results in higher transaction costs and brokerage commissions. More fundamentally, the spread diversification strategy works both ways, reducing both risk and return.

Let's say you have $120,000 invested equally in six stocks, and one stock doubles in value. Your original $20,000 investment is now worth $40,000. You've done a lot, but not as much as if you had invested all of your $120,000 in that one company. By protecting you on the downside, diversification limits you on the upside, at least in the short term. Over the long term, diversified portfolios tend to have higher returns.