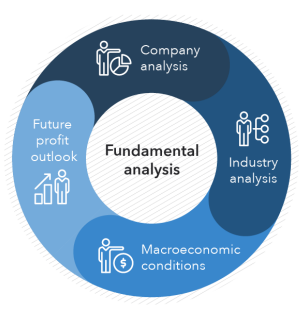

Fundamental analysis is a method used to evaluate the intrinsic value of a stock by examining various economic and financial factors. Unlike technical analysis, which relies on historical market data, fundamental analysts focus on broader aspects that can influence a stock's value. These factors include macroeconomic conditions such as the overall state of the economy and industry-specific situations, as well as microeconomic factors like the effectiveness of a company's management.

Fundamental analysts aim to determine the "real" or "fair" value of a stock or cryptocurrency. They assess a company's financial health, examining its revenue, earnings, expenses, and overall profitability. Additionally, they consider factors such as the company's competitive advantages, industry trends, and market demand for its products or services.

One renowned advocate of fundamental analysis is Warren Buffett, a highly successful investor known for his strategic stock picking based on this approach. Buffett's investment philosophy centers around understanding a company's fundamentals, which he believes provides a solid foundation for long-term investment decisions.

Critics of fundamental analysis mainly emerge from two camps: proponents of technical analysis and supporters of the efficient market hypothesis. The latter argues that it's exceedingly challenging to consistently beat the market through either fundamental or technical analysis. According to this viewpoint, the market efficiently prices all stocks, making it difficult for investors to gain a significant advantage over the long term. The vast number of market participants ensures that any potential for excess returns is swiftly reduced, limiting the opportunity for significant outperformance in the market.