A company can start small and grow as its profits allow, remaining accountable only to the owners of the company. Alternatively, companies can turn to outside investors for early support, providing a quick influx of cash, but usually in exchange for giving up a portion of their stake in the company.

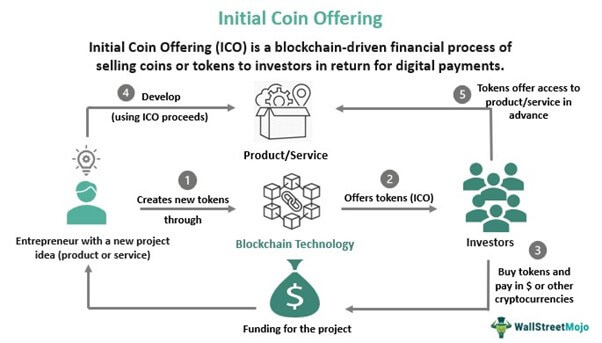

The initial coin offering (ICO) is the rough equivalent of an IPO in the traditional investment world. ICOs act as fundraisers of sorts; a company looking to create a new cryptocurrency, valuation or service launches an ICO. Then, interested investors participate in the ICO either with fiat currency or with cryptocurrencies like Ethereum or Bitcoin. In exchange for their support, investors receive a new ICO-specific cryptocurrency. Investors hope that this new cryptocurrency will provide them with an exceptional return in the future.

The company initiating the ICO uses the investor's funds as a means to further their goals, launch their product or launch their cryptocurrency. ICOs are used by startups to bypass the rigorous and regulated capital raising process required by banks. The most successful ICOs in recent years give investors reason to hold out hope, as they have indeed produced huge returns.

But this investor enthusiasm also leads people astray. Because they are largely unregulated, ICOs have become a hub for frauds and scams, seeking to prey on overzealous and uninformed investors.

Lately IEO have started to take the spotlight from ICOs, they have the advantage of allowing the investor to buy it an exchange with good liquidity. This is a guarantee of confidence to be able to resell it later when one has made enough profit.