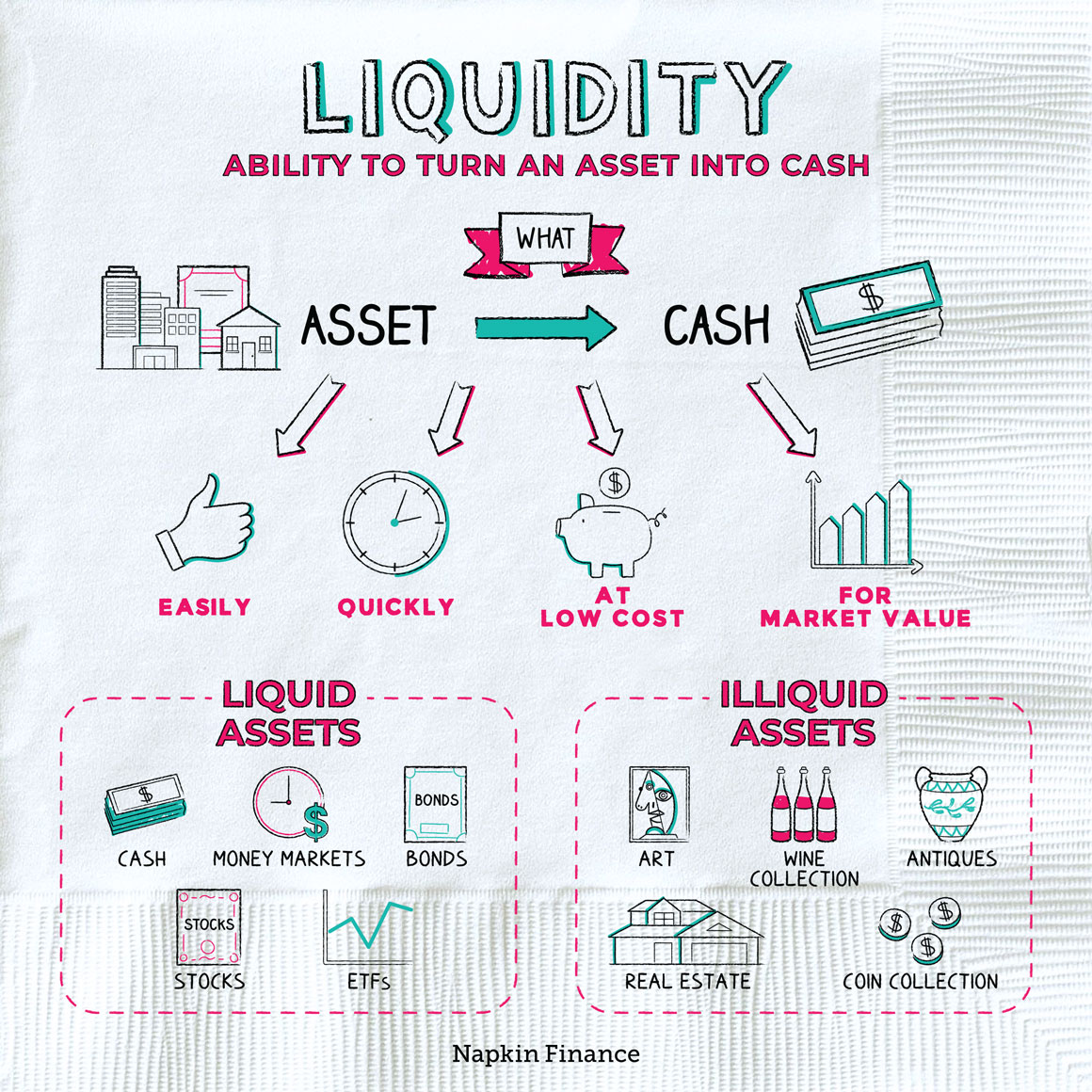

Liquidity signifies the ease and speed with which an asset or security can be swiftly bought or sold in the market while maintaining a price that accurately reflects its true value.

Among assets, cash or paper money stands as the epitome of liquidity, universally recognized for its ease of transaction. In contrast, tangible assets such as real estate, art, and collectibles lack liquidity due to the time and effort required to find suitable buyers or sellers. Financial assets, including stocks and limited partnership units, occupy different points along the liquidity spectrum, depending on market demand and trading volumes.

Consider the scenario of purchasing an ERC-20 token with limited liquidity on a decentralized exchange. In such situations, reselling these tokens becomes a complex and protracted process when compared to widely accepted cryptocurrencies. The bid-ask spread, representing the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, becomes wider as liquidity diminishes. This widening spread indicates a less liquid market, making it challenging for traders to execute transactions swiftly and efficiently.

Understanding the nuances of liquidity is crucial for investors and traders, enabling them to make informed decisions in dynamic market environments. A keen awareness of liquidity levels empowers market participants to navigate various assets and securities, ensuring optimal execution and minimizing transactional hurdles.