A Margin is money borrowed from a brokerage firm to buy an investment. Margining is borrowing money to buy securities. The practice is to buy an asset where the buyer pays only a percentage of the value of the asset and borrows the rest from the bank or broker. The broker acts as the lender and the securities in the investor's account act as the collateral.

In a general business context, margin is the difference between the selling price of a product or service and the cost of production, or the ratio of profit to revenue. For a trader, "Margin" refers to the use of money borrowed from a broker to purchase securities.

The investor is using borrowed money or leverage and, therefore, losses and gains will be magnified accordingly. It is advisable to be well versed in trading before using leverage. The BitMEX trading platform is the reference for margining up to x100 with cryptocurrencies.

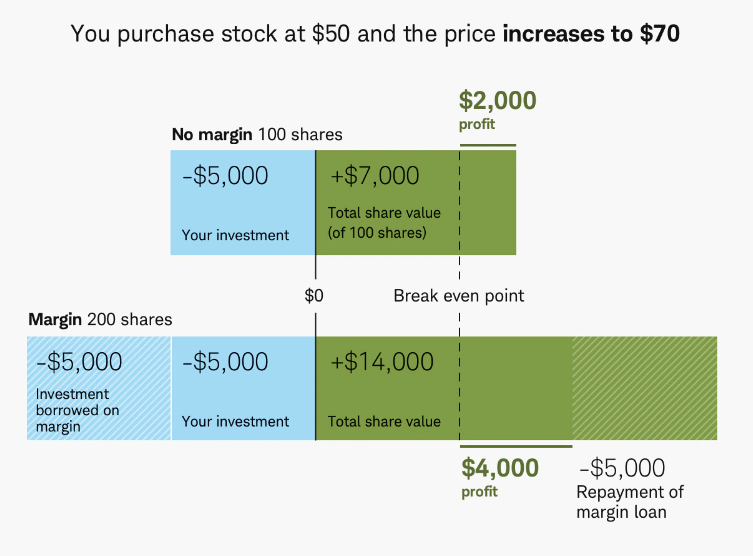

You purchase 100 shares of a stock at $50 for a $5,000 total investment. If the value of the stock you bought goes up to $70 and you decide to sell, your portfolio is worth $7,000 and you gain $2,000.

If you purchase an additional 100 shares by borrowing on margin, your total portfolio is now worth $10,000. With the 100 additional shares you bought on margin, your total portfolio is worth $14,000 (200 total shares times $70 price). If you decide to sell at this point, you still have to pay back the $5,000 loan, but your gains would be $2,000 more than if you had only used your money instead of margin.

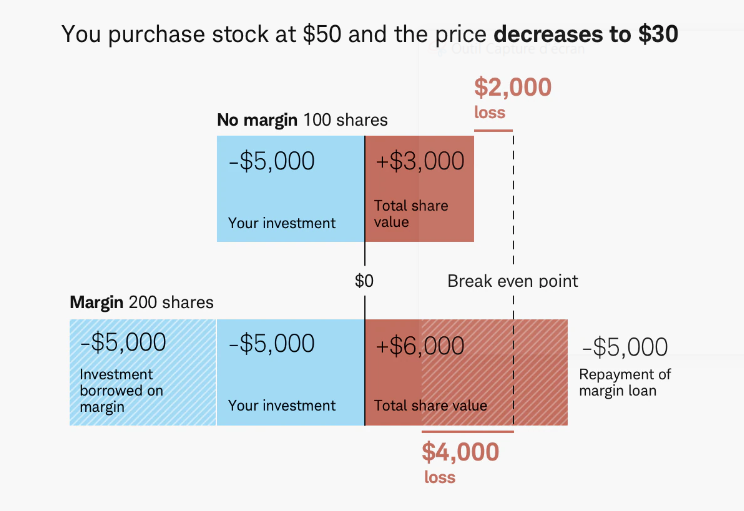

If the value of the stock you bought drops from $50 to $30 and you decide to sell, your portfolio is worth $3,000 and you lose $2,000.

If you purchase an additional 100 shares by borrowing on margin, your total investment is $10,000. With the 100 additional shares you bought on margin, your total portfolio is worth $6,000 (200 total shares times $30 price). If you decide to sell at this point, you still have to pay back the $5,000 loan, leaving you with $1,000 and a $4,000 loss.