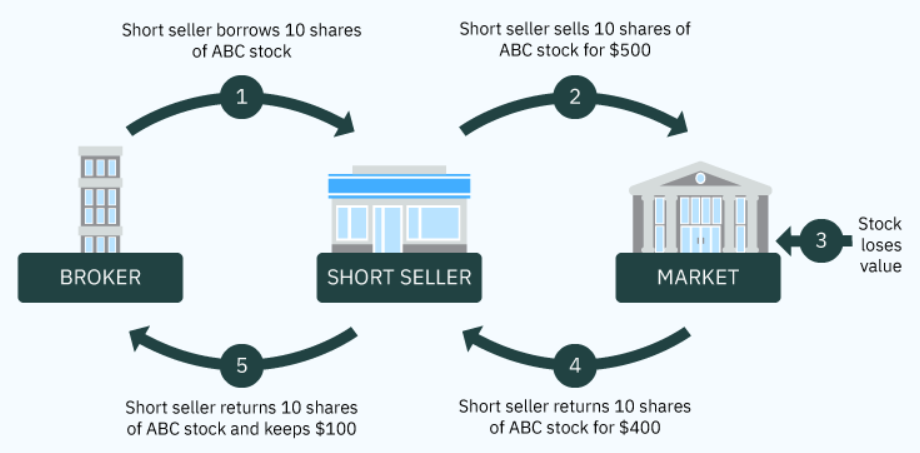

Short selling is a trading strategy where a trader sells a security that they do not own with the intention of buying it back later at a lower price. This approach allows traders to profit from the decline in a stock's price. When initiating a short position, it's crucial to understand that the profit potential is limited, while the potential losses are theoretically unlimited.

Here's how it works: Let's say a trader believes the price of Bitcoin is going to decrease. To capitalize on this prediction, the trader borrows Bitcoin and sells it at the current market price, let's say $1,500. Later, if the price drops to $1,300, the trader buys back the same amount of Bitcoin. In this scenario, the trader makes a profit of $200 ($1,500 - $1,300).

However, it's important to note that short selling comes with significant risks. Unlike buying a stock, where the maximum loss is the initial investment, short selling losses can theoretically accumulate without limit if the stock price rises instead of falls. For example, if the price of Bitcoin had risen to $1,700 instead of falling, the trader would incur a loss of $200 ($1,700 - $1,500). If the price continued to rise, the losses would keep mounting.

Short selling requires careful consideration, a thorough understanding of the market, and precise timing. Traders need to be aware of the risks involved and have a well-thought-out exit strategy to manage potential losses. While it can be a profitable strategy in a declining market, it demands a high level of expertise and risk management to execute successfully.