A bubble is a business cycle characterized by a rapid escalation in asset prices followed by a contraction. It is created by a surge in asset prices that is not justified by the fundamentals of the asset and is fueled by exuberant market behavior. When there are no more investors willing to buy at a high price, there is a massive sell-off, which causes the bubble to deflate.

Bubbles form in economies, securities, stock markets and industries due to a change in investor behavior. During the internet business boom, people bought technology stocks at high prices, believing they could sell them at a higher price until confidence was lost and a major market correction, or crash, occurred.

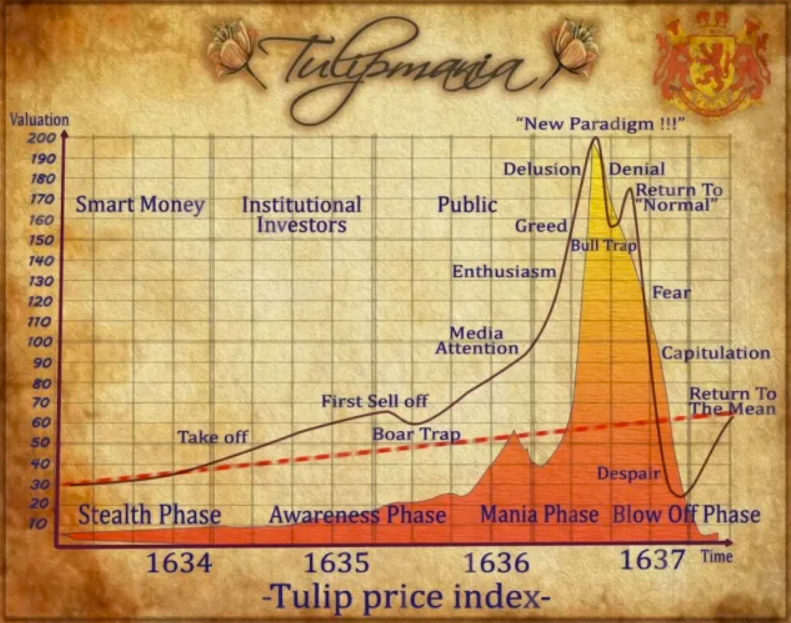

Economist Hyman P. Minsky has identified five stages in a typical bubble cycle:

- Displacement: This stage occurs when investors begin to notice a new paradigm, such as a new product or technology, that catches their attention.

- Boom: Prices first begin to rise, then soar as more and more investors enter the market.

- Euphoria: When euphoria hits and asset prices soar, caution is the order of the day.

- Profit-taking: It's not easy to know when the bubble will burst; once a bubble bursts, it won't inflate again. But anyone who watches the warning signs will make money by selling positions.

- Panic: Asset prices change course and fall as quickly as they rose. Investors and others want to liquidate them at any cost. Asset prices fall as supply exceeds demand.

The most popular example of a speculative bubble is the case of the Tulip in Holland in the early 1600s. The price of tulip bulbs reached record highs before collapsing, creating a panic that spread throughout Europe. Some investors compare the Bitcoin bubble to the tulip bubble, but it could just as easily be compared to the Dot-Com bubble of the late 1990s, which gave birth to the Internet giants.