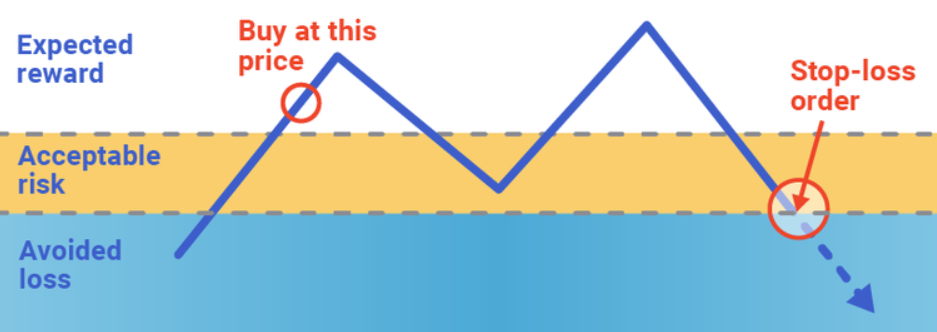

A stop-loss order is a strategic tool used by investors to minimize potential losses in the stock market. When an investor places a stop-loss order with a broker, it means they have specified a particular price at which the broker should automatically buy or sell a security. The primary purpose of a stop-loss order is to limit losses on a stock position.

Here's how it works: Let's say an investor buys a stock at $100 per share. To protect against significant losses, they place a stop-loss order at $90, which is 10% below the purchase price. If the stock's value drops to $90 or below, the stop-loss order is triggered, and the broker sells the stock as a market order. This ensures that the investor doesn't incur further losses if the stock continues to decline.

Using a stop-loss order provides a level of protection by converting the order into a market order when the specified price is reached. This eliminates the risk of the order not being executed in a rapidly declining market. However, it's important to note that if the stock suddenly plunges below the stop price, the order will be triggered, and the stock will be sold at the next available market price, even if it's lower than the stop-loss level.

By employing stop-loss orders, investors can manage their risks more effectively, allowing them to safeguard their investments and make well-informed decisions in volatile market conditions.