Rebalancing is a fundamental strategy in managing an investment portfolio. It involves adjusting the balance of assets within the portfolio to maintain a desired level of risk or allocation. This process ensures that the portfolio stays in line with the investor's financial goals and risk tolerance.

Here's how it works: Imagine an investor initially decides to split their portfolio equally between stocks and bonds, creating a 50/50 allocation. Over time, due to market fluctuations, the value of stocks may increase, skewing the balance to, for instance, 70% stocks and 30% bonds.

To restore the portfolio to its original allocation, the investor needs to rebalance. This means selling a portion of the overperforming asset (in this case, stocks) and using the proceeds to buy more of the underperforming asset (bonds). By doing so, the investor brings the portfolio back to the intended 50/50 balance.

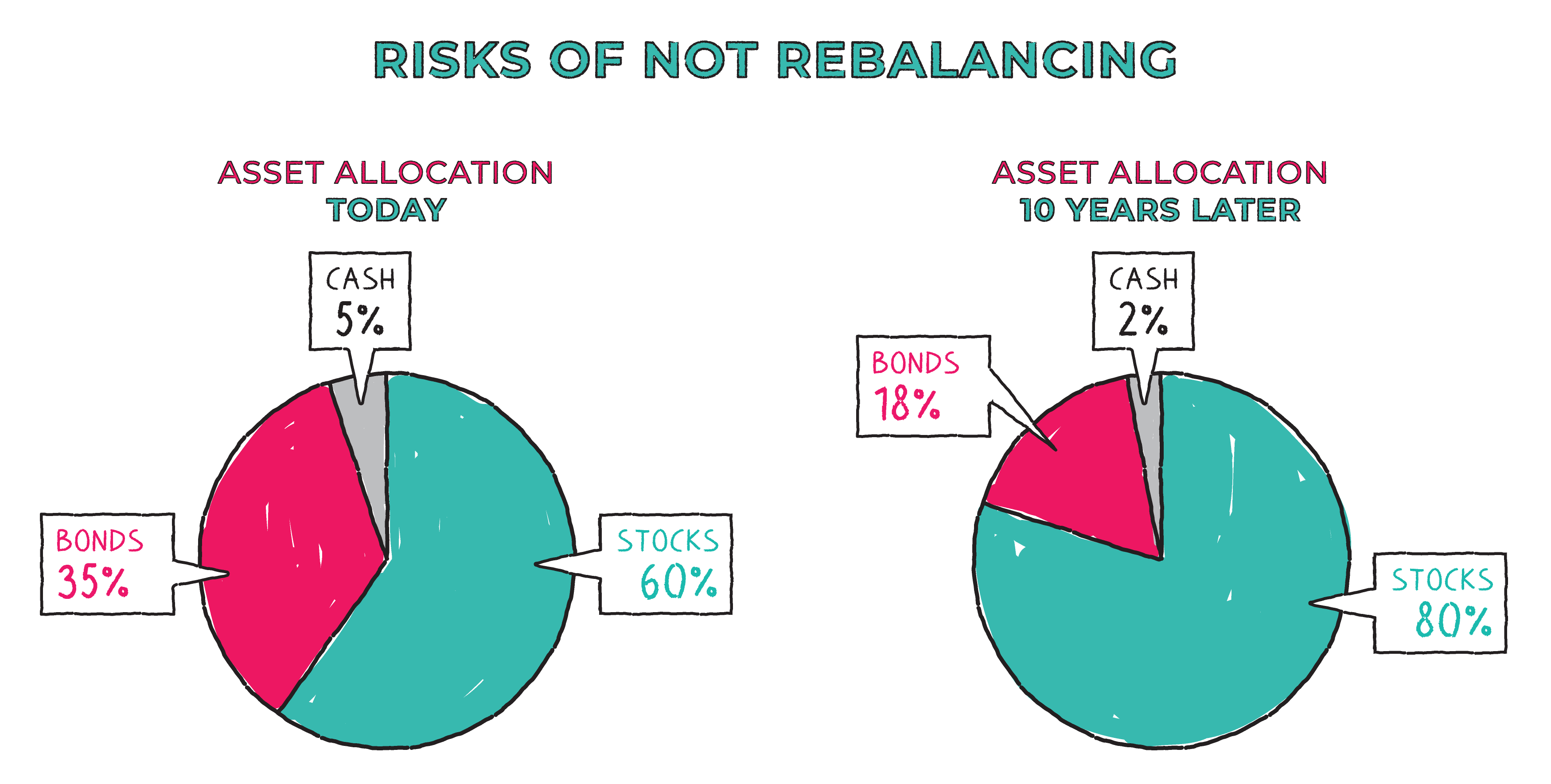

Rebalancing is crucial because it helps manage risks. If an investor allows an asset to become overly dominant in the portfolio, it can increase the overall risk. Regularly rebalancing maintains the desired risk level, ensuring a more stable and consistent investment strategy.

Investors often set specific time intervals, like quarterly or annually, for rebalancing. Alternatively, some opt for a 'threshold' approach, rebalancing only when the asset allocation deviates significantly from the original plan, usually around 5-10%.

By adhering to a disciplined rebalancing strategy, investors can maintain a well-diversified and risk-appropriate portfolio, aligning their investments with their financial objectives while minimizing unnecessary risks.