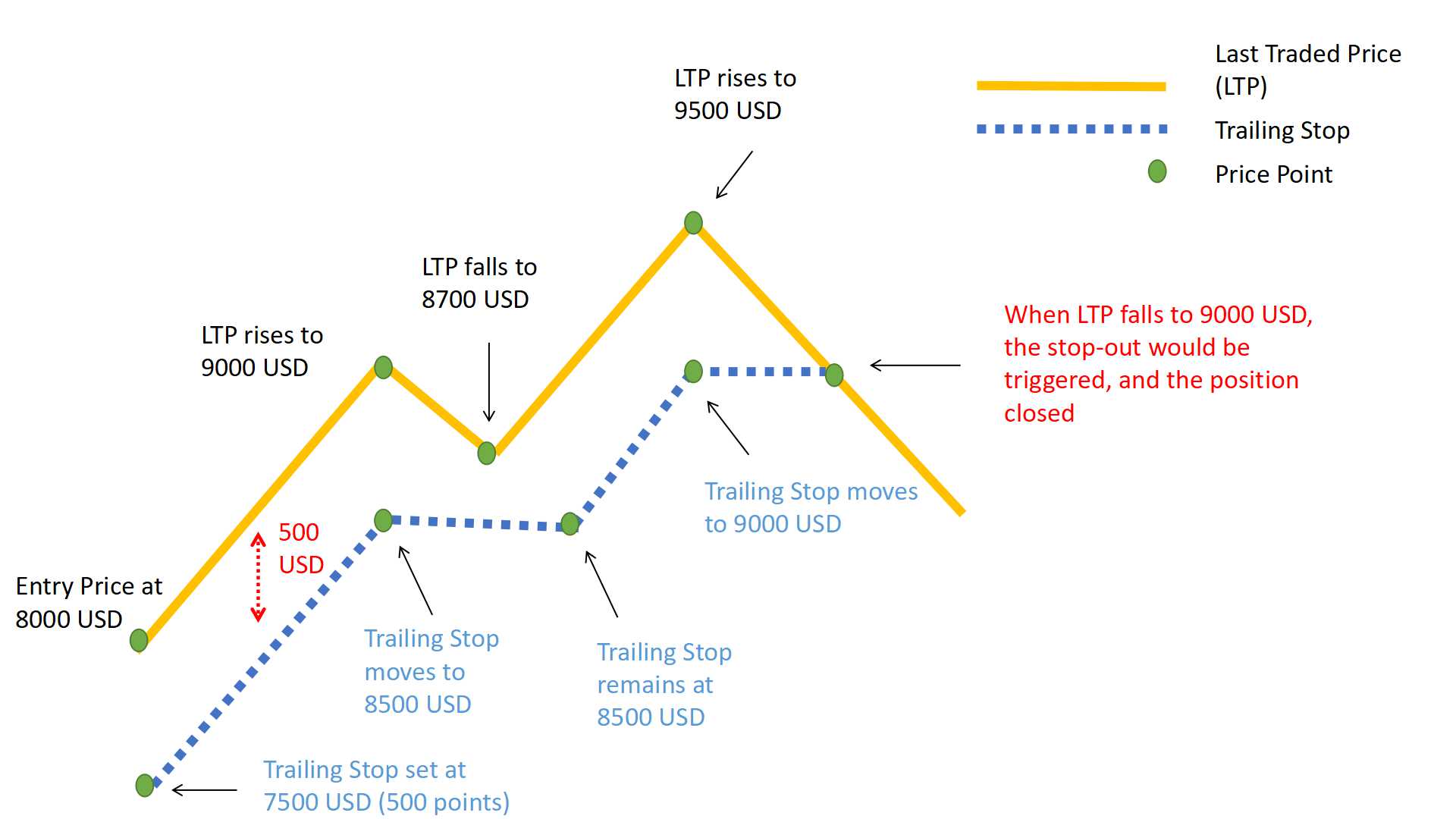

A trailing stop is a stop order that can be set at a defined percentage or dollar amount away from the current market price of a stock. For a long position, place a trailing stop loss below the current market price. For a short position, place the trailing stop above the current market price.

A trailing stop is designed to protect gains by allowing a trade to remain open and continue to profit as long as the price moves in the investor's favor. The order closes the trade if the price changes direction by a specified percentage or amount.

A trailing stop is more flexible than a fixed stop-loss order, as it automatically follows the direction of the stock price and does not need to be manually reset like a fixed stop-loss. Investors can use trailing stop orders in any asset class, assuming the broker provides this type of order for the market being traded. Trailing stops can be defined as limit orders or market orders.

A trailing stop that is too large will not be triggered by normal market movements, but it does mean that the trader is taking the risk of incurring unnecessarily large losses, or giving up more profit than he needs to. For example, suppose you bought Alphabet Inc (GOOG) at $1,000. Looking at the stock's past advances, you see that the price often falls 5% to 8% before rising again. Using a 10% stop order, your broker will execute a sell order if the price falls 10% below your buy price. If the price never rises above $1,000 after you buy, your stop loss will remain at $900. If the price reaches $1,010, your stop loss will increase to $909, which is 10% below $1,010. If the stock rises to $1,250, your broker will execute a sell order if the price falls to $1,125.